Racing to the Bottom: Pawlenty’s shift in the tax burden

Recently, Gov. Pawlenty announced in his State of the State Address his proposals for Minnesota to foster the creation and retention of jobs, and encourage revenue growth in the long term. Among those proposals was the extension of his prized Job Opportunity and Building Zones (JOBZ) program to the St. Paul Ford Plant, and a reduction of the Corporate Franchise Tax (more commonly known as the corporate income tax) rate by 20%. Although the corporate income tax represents a small portion of the general tax revenue (7.58% in 2007), and JOBZ has had received modest amounts of applications (312 tax exception deals in 7 years), Gov. Pawlenty doesn’t acknowledge the potential costs of these two initiatives in both tax revenue lost, and the tax incidence shift from corporate generated revenue to other revenue sources.

MN JOBZ Program

The extension of the MN JOBZ program to the Ford Plant in St. Paul, represents and expansion of the scope of a corporate tax exemption program beyond its original intent of encouraging firm growth or relocation in depressed cities in the state. Gov. Pawlenty’s proposed expansion of the JOBZ program does not recognize the initiative’s past criticisms reflected in the 2008 evaluation by the Office of the Legislative Auditor or potential costs associated with creating a precedent that increases the eligibility for corporate tax exceptions. Since its inception, JOBZ has distributed approximately $76.8 million in tax benefits to businesses in Minnesota. An expansion in eligible businesses would increase this figure.

What is the Corporate Income Tax?

Within

The Corporate Income Tax and

Currently,

| Country/State | |

| | 12 |

| | 9.99 |

| Dist. Of | 9.975 |

| | 9.8 |

| | 9.5 |

| | 9.4 |

| | 9.36 |

| | 9 |

| | 9 |

| | 8.93 |

| | 8.9 |

| | 8.84 |

| | 8.7 |

| | 8.5 |

| | 8.5 |

| | 7.9 |

| | 7.81 |

| | 7.6 |

| | 7.6 |

| | 7.5 |

| | 7.5 |

| | 7.35 |

| | 7.3 |

| | 7 |

| | 7 |

| | 6.968 |

| | 6.9 |

| | 6.75 |

| | 6.6 |

| | 6.5 |

| | 6.5 |

| | 6.4 |

| | 6.4 |

| | 6 |

| | 6 |

| | 6 |

| | 6 |

| | 6 |

| | 5.5 |

| | 8 |

| | 6.25 |

| | 5.1 |

| | 5 |

| | 5 |

| | 5 |

| | 4.63 |

| | 6.5 |

| Texas | 0 |

| | 0 |

| | 0 |

| | 0 |

Eliminating Tax Revenue

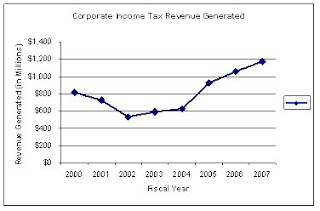

Since 2000, the corporate income tax has seen the largest percentage gains in increased as a share of total revenue compared with sales and income tax, regardless of its high rate. In 2000,

Although Gov. Pawlenty argues that the reduction in the corporate in come tax will encourage firm growth and relocation to Minnesota in the long-term, revenue generated from this tax decrease would not be fully realized for multiple years because of a) the time needed for firm creation or relocation can be great; b) the current recession could continue to suppress corporate revenue into the near future, decreasing taxable profits; or c) the continuation of the Minnesota Department of Employment and Economic Development over use of the JOBZ program to attract firms to Minnesota will decrease the amount of taxable profit from firms due to the JOBZ corporate income tax exemption. To account for the revenue lost in the short term, the Governor’s office, and the MN State Legislature would have to further reduce current expenditures, or offset the decrease in revenue through increasing tax revenue from other sources. (such as a 3.24% increase in income tax revenue, or a 5% increase in sales tax revenue)

Regardless of the scenario chosen (reduction in expenditures or increase in alternative taxes) the reduction in the tax rate for the corporate income tax decreases the tax incidence on corporations, and shifts the tax burden on residents. Although, individuals will gradually assume greater tax burden for the generation of state revenue, it will be unlikely that citizens will fully realize the shift in burden until an attempt to offset the revenue loss through an alternative means of generating revenue because they do not directly pay the corporate income tax. Additionally, the benefits for the reduction in revenue from a reduction in the corporate income tax can not be immediately realized by the state. Considering the current financial situation of the Minnesota State Budget, a proposed reduction in revenue can add difficulties in ensuring a balanced budget for the next budget cycle.

“The art of taxation consists in so plucking the goose as to obtain the largest amount of feathers with the least amount of hissing” - Jean Baptiste Colbert

[1] Proportion of tax revenue generated supplied by state revenue data collected by the Nelson A. Rockefeller Institute of Government. http://www.rockinst.org/government_finance/revenue_data.aspx

No comments:

Post a Comment